Business Development Associate

As a Business Development Associate at ARS Investment Partners, I am responsible for developing and managing relationships with institutional clients as part of the firm’s distribution strategy. I’m always looking for ways to add value, support my colleagues, and contribute to the continued growth and success of our team.

I hold a Bachelor of Science in Business and Technology Management with a concentration in Financial Strategy from New York University. My academic experience provided a strong foundation in both finance and innovation, tools I leverage daily in my role and continue to develop.

One of the most fulfilling aspects of my role is working alongside a team whose sophisticated thought leadership is grounded in a shared commitment to being perpetual students of the market. The market and all its fluctuations fascinate me; each day brings new challenges, opportunities, and insights. It’s exciting to be part of a firm at the forefront of financial innovation, constantly evolving to provide the best solutions available. I feel fortunate to be in an environment where there is always more to learn and where our work has a meaningful impact on helping clients achieve their financial goals.

Outside of work, I enjoy exploring New York City with my friends and my dog, Cody. I also enjoy visiting my family in New Jersey and find creative expression through fashion and beauty. I am a volunteer with New York Cares, which allows me to stay connected to the broader community and give back in meaningful ways. These personal passions help me stay grounded and bring a sense of balance to both my personal and professional life.

Client Services Associate

Samuel Alabre is a Client Service Associate with over four years of experience in financial services, fintech, and client relationship management. He specializes in delivering high-quality client support, managing complex transactions, and enhancing operational efficiency. Samuel holds a Bachelor of Arts in Social Sciences with a focus in Psychology from Dominican University and a Master of Business Administration from Albertus Magnus College.

Business Development Associate

As a Business Development Associate at ARS Investment Partners, my primary responsibilities involve supporting the firm’s distribution efforts by acquiring, developing, and managing relationships with institutions. I am thrilled to be part of a team that is dedicated to excellence and continuous learning in the global economy and financial markets.

Before joining ARS Investment Partners, I worked at Clearnomics, a startup focused on providing market and economic insights for advisors. This experience honed my skills in market analysis and client relationship management, preparing me well for my current position.

I hold a Bachelor of Arts from Columbia University, where I also played Division 1 Basketball and served as Team Captain. Graduating in May 2022, my time at Columbia taught me the value of leadership, teamwork, and dedication—qualities that I bring to my professional life every day.

My motivation lies in knowing that I represent ARS Investment Partners. As perpetual students of the global economy and financial markets, I could not be more excited to be a part of this business. I genuinely enjoy waking up each day to do what I love, learning from my colleagues, and making an impact in any way I can.

Outside of work, I am a big fan of sports, particularly Boxing and MMA. In my free time, I enjoy working on my fitness, socializing with friends, and exploring new restaurants and activities in NYC. These interests help me maintain a balanced and fulfilling life, both personally and professionally.

Director of Business Development

As the Director of Business Development at ARS Investment Partners, my primary responsibilities include handling all facets of marketing and distribution of our asset management strategies through various intermediaries, including RIAs, B/Ds, banks, TAMPs, endowments, foundations, pensions, and institutional consultants.

With over 33 years of experience in the financial services industry, I have had the opportunity to work at esteemed firms such as Oppenheimer Funds, DWS, and BONY Mellon Dreyfus. My journey in this industry has been both challenging and rewarding, and I am grateful for the continuous learning opportunities it provides. Even after all these years, I find that there is always something new to learn.

I obtained my Bachelor’s Degree in Business Management from Temple University, which laid the foundation for my career in finance. I am passionate about helping people, whether that means assisting end clients or supporting advisors in providing solutions to their clients. My goal is to help advisors grow their businesses by offering thought leadership that stands out from the usual content they receive from others. The topics we discuss and write about are the very issues that business owners and C-suite executives worry about for their own businesses.

I was born and raised in Phoenixville, Pennsylvania, and I currently reside in Wayne, Pennsylvania, with my wife, Jennifer. Together, we have three adult sons: Chris, Luke, and Tom. Outside of work, I have been actively involved in my local community, serving on the board of directors for the local school district’s ice hockey club for the past nine years. My involvement began when my kids were playing hockey with the club, and I continue to stay involved because I want to see it grow and attract kids to this lifelong sport. In my free time, I love to travel with my family. I also enjoy golfing and cooking, which provide a great balance to my professional life.

Managing Partner

As the Managing Partner and Director at ARS Investment Partners, I oversee all aspects of the firm’s operations. I joined ARS in 2007 and became the firm’s CEO in 2010. Throughout my career, I have specialized in working with family offices, institutions, and high-net-worth families with a long-standing focus on helping families with special needs.

During my 40-plus-year career, I have held various leadership positions at Deutsche Asset Management, Standish Mellon Asset Management, and the Dreyfus Corporation, where I started my career. I currently serve as a director on the boards of ARS and Amgine AI, and previously served on two mutual fund boards. I earned my BA in Business Administration from Gettysburg College.

I live in New York City with my wife, Carol. Together, we have four adult children. Outside of work, Carol and I, who volunteer as puppy raisers, are proud supporters of America’s VetDogs/Guide Dog Foundations and the Cystic Fibrosis Foundation. In my free time, I enjoy reading, traveling, boating, scuba diving, and underwater photography.

Partner

As a Partner at ARS Investment Partners, my primary responsibility is portfolio management. With over 37 years of experience in the financial services industry, I specialize in investment management with a focus on compounding our clients’ capital through a risk-managed approach. I began my career after obtaining a B.S. in Economics from Southern Connecticut State University in 1985. My commitment to professional growth led me to earn the Chartered Financial Analyst® (CFA®) designation in 1996. Before joining ARS Investment Partners, I worked at Artemis Wealth, where I honed my skills and deepened my understanding of the financial markets.

What motivates me most is the constant learning that comes with this profession. Markets are always changing and evolving, and I thrive on staying ahead of these changes to better serve my clients. The aspect of my job that I enjoy the most is helping clients meet their financial goals and earning their trust as their advisor. I believe that the greatest value I can provide is my ability to make complex financial concepts simple and accessible for my clients. Through my work and personal life, I strive to bring clarity, trust, and effective financial strategies to those I serve, always aiming to simplify the complexities of the financial world for my clients.

I currently live in my hometown of Verona, New Jersey, with my wife, Rena. Together, we have two adult children, Quinn and Sloan. Outside of work, I am actively involved in the CFA Institute and the NY Society of Security Analysts to stay current with industry trends and continue my professional development. In my free time, I like to maintain an active lifestyle and enjoy spending time with my family. We engage in various sports in a friendly – but competitive – manner, which keeps us all connected and energized.

Client Services Associate

I have had the privilege of working in the financial services industry for over two decades. Throughout my career, I have remained committed to continuous learning and adaptation, always striving to provide the best possible service and insights to my clients and colleagues.

My finance career began in 2001 in JP Morgan’s swap group. In 2002, I joined the operations department at Clinton Group, a multi-strategy hedge fund, where I handled settlements in equity, convertible bonds, options, Treasuries, and mortgage-backed securities.

In 2004, I transitioned to the trading desk at Clinton Group, where I was responsible for hedging the convertible bond portfolio in addition to my operational duties. This experience provided me with a comprehensive understanding of both the operational and trading aspects of finance.

In 2006, I moved to Bear Stearns and then to Morgan Stanley in 2008, both in the Prime Brokerage divisions. These roles further honed my skills and deepened my knowledge of the financial markets.

In January 2009, I joined Somerset Capital Advisers, LLC, which subsequently merged into ARS Investment Partners. This move marked a significant step in my career, allowing me to bring my extensive experience to a new team and contribute to our collective success.

I hold a BS in Business Administration with an emphasis in Finance and Accounting from the University of Colorado. My educational background, combined with my diverse professional experiences, has equipped me with a robust understanding of the financial industry and the ability to navigate its complexities effectively.

Client Services Associate

As a Client Services Associate at ARS Investment Partners, I am responsible for responding to client calls and emails, managing asset movements, account opening and maintenance, account updates, and handling all associated documentation. With over 5 years of experience in the financial services industry, I am dedicated to providing efficient and prompt service to meet our clients’ needs.

My educational background includes an Associate of Arts degree from Norwalk Community College, which I obtained in May 2018, and a Bachelor of Arts in Human Development & Family Sciences with a minor in Psychology from the University of Connecticut, completed in May 2021. Currently, I am enrolled in Boston University’s Certified Financial Planner education program and expect to complete my coursework in August 2025.

One of the most rewarding aspects of my job is being introduced to and getting to know so many new people from different walks of life. I believe that the greatest value I can provide for our clients is my efficiency and ability to promptly address their needs, ensuring a smooth and satisfying experience.

I currently live in my hometown of Stamford, Connecticut. In my free time, I enjoy caring for over 25 houseplants and spending time outdoors with my dog, Ellie. I have a special place in my heart for honeybees and hope to have a hive of my own someday. Nature is incredibly healing for me, so I try to get outside as often as I can. When the weather is bad or the sun goes down, I love playing “cozy” video games like Animal Crossing, Stardew Valley, and The Sims.

Partner

As a Partner and Portfolio Manager at ARS Investment Partners. In my role, I am a member of the Investment Committee, the driving force behind stock selection and portfolio construction across three of the firm’s primary investment strategies: All Cap, Core, and Focused Small Cap. With over 40 years of experience in the financial services industry, I have developed a deep understanding of market dynamics and investment strategies. Prior to joining ARS Investment Partners, I worked at Caxton Associates, where I served as a Partner and Managing Director. My educational journey began at the University of Puget Sound, where I completed my undergraduate studies. I then went on to earn an MBA from the Wharton School of Finance and Commerce, which provided me with a solid foundation in financial principles and business management.

As a professional, I am motivated by the desire to do the best job I can for our clients at all times. What excites me about the business is the daily puzzle it presents and the need to constantly open my mind to adapt to ever-changing realities. I enjoy the challenge of understanding the intersection of ideas and people. Outsiders often think that investing is all about numbers, but in reality, it is just as often about people – whether they are boards and management teams, sell-side analysts, or other investors. I believe that the greatest value I can provide for my clients is my commitment to always do everything I can to put their long-term investment interests first. This dedication drives me to continually seek out the best opportunities and make informed decisions that align with their goals.

Originally from the Seattle, Washington area, I have called Stamford, Connecticut home for the past 30 years. My family includes my bride of 32 years, our 24-year-old daughter, and our seven pups. Outside of work, I am actively involved with an organization called CTIPA, which aims to revive debate in society and teach people not to be afraid of venturing into the unknown. The organization comprises former senior members of the Special Operations community, and its lessons are valuable to business leaders, politicians, and everyday citizens alike. Dialogue and respect are essential to retaining our democracy, and CTIPA is working to make that hope a reality.

In my free time, I enjoy golfing, painting, reading, cooking, and driving. Much of what I do professionally shows up only in numbers on a page, so I find great satisfaction in engaging in activities that are more tangible.

Portfolio Manager

I currently serve as the Portfolio Manager of a long-short fund and as a Portfolio Manager of the All Cap and Core Strategies at ARS Investment Partners. In these roles, I am responsible for managing the long-short fund and sit on the Investment Committee for the All Cap and Core strategies.

My journey into the financial world began at the University of Chicago, where I earned a bachelor’s degree in Economics. The rigorous academic environment and the opportunity to delve deeply into economic theories and their real-world applications fueled my passion for finance.

With over 19 years of experience in the financial services industry, I have had the privilege of working with some remarkable firms and teams. Before founding our long-short equity fund, I was a Senior Analyst with Equity Contribution at Charter Bridge Capital, where I managed the firm’s investments in the technology, media, and telecom sectors, as well as select consumer investments. Prior to that, I served as a Senior Analyst at Cobalt Capital, overseeing the firm’s technology, media, and telecom investments. My career also includes a tenure at Tiger Europe Management as a Senior Analyst, and I began my investment career in 2006 at Ampere Capital Management. At Ampere, I initially worked as a Junior Analyst and later advanced to the position of Assistant Portfolio Manager, focusing on consumer, media, telecom, and technology investments.

Throughout my career, I have been driven by the opportunity to continuously evolve and learn. The dynamic nature of the financial markets requires a constant adaptation and growth mindset, which I find incredibly motivating and rewarding. Currently, I reside in Manhattan, New York, where I continue to pursue my passion for finance and investment management.

Chief Compliance Officer and Chief Operating Officer

As the Chief Operating Officer and Chief Compliance Officer at ARS Investment Partners, my primary responsibilities include overseeing our business operations and managing regulatory compliance across the firm. I have been immersed in the financial services industry since 1987, bringing a wealth of experience and knowledge to my current roles.

Throughout my career, I have held various presidential and directorial positions at several brokerage and advisory firms. Most recently, I served as the Director of Practical Compliance at MarketCounsel, a compliance consulting firm, before joining ARS in 2017. My journey in this industry began after obtaining a BA in Economics with a minor in Business Administration from Boston University in 1987.

I am deeply motivated by solving problems, and I thrive on the fact that no two days are alike in this field. The pace, variety of challenges, and constant evolution within the industry, our firm, and my roles keep me engaged and passionate about my work. Although I do not have advisory clients, I consider my colleagues my clients. My value lies in leveraging my experience and analytical skills to support them, introducing new resources or processes to enhance their work life, and solving problems where they meet challenges.

A native of Long Island, New York, I currently reside in Stamford, Connecticut, and am a proud parent of three adult children. Outside of the office, I am actively involved with Friends of Felines, a cat rescue organization. Outside of volunteering there, I enjoy gardening, reading, and staying active with friends, family, and my pets.

Head Trader

As the Head Trader at ARS Investment Partners, my primary responsibilities include executing equity and fixed income orders. With over 34 years of experience in the financial services industry, I bring a wealth of knowledge and expertise to my position.

Before joining ARS Investment Partners in 2000, I spent seven years at H.C. Wainwright & Co., Inc. in Boston. As an equity trader at ARS, I actively monitor stocks on our interest and holdings list for any news, earnings announcements, and all pertinent information that could affect our clients’ portfolios or managers’ investment decisions. I continuously analyze market trends, conditions, and developments to formulate effective and profitable trading strategies. I aggressively use daily and intraday charts for trading decisions and to analyze trends and patterns, while reviewing and listening to morning sales calls, morning notes, economic data, and both technical and fundamental research. My extensive experience and dedication to staying informed on market developments enable me to execute trades effectively and contribute to the success of our clients’ investment strategies.

A native of Boston, Massachusetts, I currently reside in Manhattan. In my free time, I enjoy skiing and cooking, both of which offer me a chance to unwind and engage in activities that I am passionate about.

Compliance Associate

As a Compliance Associate at ARS Investment Partners, my career has been dedicated to ensuring regulatory adherence and maintaining the highest standards of compliance, particularly as a certified Investment Advisor Association Compliance Professional. With over 24 years of experience in the financial services industry, I have had the opportunity to work at esteemed institutions such as Bank of New York Mellon and Insight Investment.

I hold a BA in History from Lehigh University and a JD from Boston University School of Law. This educational background has equipped me with a robust understanding of both the historical context and legal frameworks that underpin the financial industry. I am deeply motivated by the ever-changing nature of compliance. The dynamic landscape of regulations and guidelines keeps me engaged and constantly learning, which is something I truly enjoy about my profession.

I was born in Ecuador and raised in New Jersey, a diverse background that has enriched my perspective and approach to my work. I currently live in Manhattan, where I embrace the vibrant energy of the city. Outside of work, I am an avid dog lover and find great joy in spending time with my four-legged friends.

Portfolio Manager

As a Portfolio Manager at ARS Investment Partners, I am deeply motivated by the opportunity to help individuals, families, and institutions navigate the complexities of investing. I believe that the greatest value I can provide for my clients is serving as their trusted partner, guiding them through the intricacies of the financial landscape and helping them achieve their investment goals. With over 17 years of experience in the financial services industry, I have had the privilege of working at some of the most respected firms, including Morgan Stanley, Telsey Advisory Group, and Citi Global Markets. Before beginning my career, I attended Pepperdine University, where I developed a strong foundation in finance and investment principles.

In my role, I most enjoy a combination of helping others invest, observing market trends, and allocating capital when the opportunity arises. There is nothing more rewarding than seeing my clients succeed and knowing that I have played a part in their financial well-being.

I currently live in my hometown of New Canaan, Connecticut, with my wonderful wife, Jennison, and our two children, Charlie and Vivienne. In my free time, I enjoy playing golf, playing squash, and chasing the kids around. These activities help me maintain a healthy work-life balance and keep me grounded.

Director of Operations

I am the Director of Operations at ARS Investment Partners, where my primary responsibilities include overseeing the day-to-day operations and activities in client accounts, as well as managing firm operations. With over 28 years of experience in the financial services industry, I bring a wealth of knowledge and expertise to my role.

Before joining ARS Investment Partners, I was an equity trader and principal at ARS Management, an unaffiliated research firm and broker-dealer. My journey in this field began after I earned a bachelor’s degree in history from Denison University.

I have been with ARS for 19 years, and I believe that my depth of knowledge and experience provides our clients with a sense of stability, understanding, and assistance that is hard to find elsewhere. I look forward to helping our clients by ensuring our technology and services are running smoothly and are kept up to date with the latest enhancements to improve the client experience.

What I enjoy most about my job is the team I work with and the opportunity to help clients and their families grow their assets. There is a unique satisfaction in knowing that our efforts contribute to the financial well-being of those we serve.

Controller

I am the Controller at ARS Investment Partners, where my primary responsibilities are to ensure data accuracy and compliance within our portfolio management system, especially with our performance verification. I make sure that our portfolio managers and traders have access to any information they require and assist with financial and performance reporting. Additionally, I oversee the maintenance of our computer systems and act as a first responder for any issues related to these systems.

One of my specialties is finding ways to explain how different areas of our system work so that employees can maximize the data and systems they use. With technology constantly advancing, many employees struggle to understand how various systems operate and how to extract the information they need. I take pride in explaining why systems work the way they do and what they can achieve, enabling my colleagues to use these tools more efficiently.

I have been working in the financial services industry for over 24 years. Before beginning my career, I earned a bachelor’s degree in accounting from the University of Notre Dame. What excites me most about my business is that it is constantly evolving. With each change, I must re-examine my processes and find the best ways to become more efficient.

I particularly enjoy troubleshooting workflows and data problems. I like breaking everything down into its parts and then putting them back together in more efficient and accurate ways to solve problems and prevent them from recurring.

Born and raised in Clifton, New Jersey, I currently live in Bloomfield, New Jersey, with my two daughters. In my free time, I enjoy spending time with them and allowing them to have new experiences.

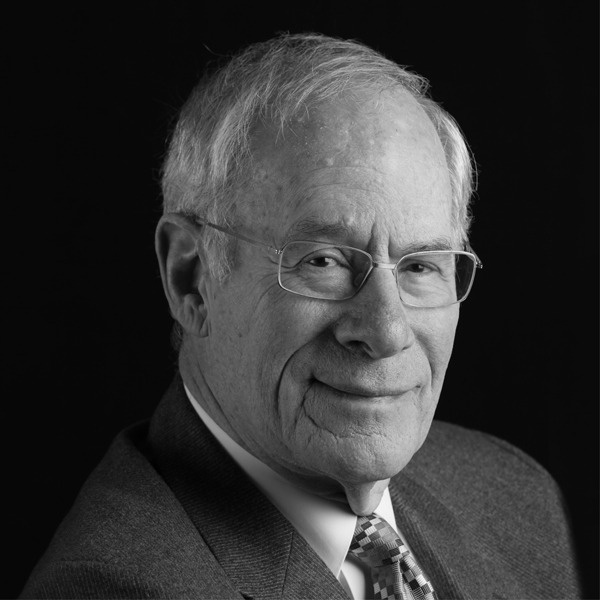

Senior Partner

I am a Senior Partner, Member of the Operating Committee, and Member of the Investment Committee at ARS Investment Partners. My primary responsibilities revolve around economic and investment research, a field I have been passionately involved in for over 60 years. My journey in the financial services industry began with roles at A.W. Benkert & Company. In 1971, I founded A.R. Schmeidler & Co., which later evolved into ARS Investment Partners.

I hold a BS in Economics from New York University and an MS in Finance from Columbia University. My career has been driven by the intellectual stimulation of learning new things, researching global trends, understanding businesses, and building dialogues with the executives who run them. What I enjoy most about my job is the meaningful work – helping people and institutions while satisfying my intellectual curiosity.

I firmly believe that the greatest value I can provide for my clients is growing their capital. This, in turn, offers individuals and families more choices in life and enables institutions to have more capital to fulfill their mandates.

Born and raised in New York City, I now reside in Westchester County, New York, with my wife. Together, we have two children and four grandchildren. Before I chose the investment field, I considered a career as a classical pianist, encouraged by my friend and mentor, Arthur Rubinstein. I had the unique experience of being Rubinstein’s page turner for several years, including during his acclaimed Carnegie Hall recordings of The Rubinstein Collection. I continue to play and record classical piano, with my recordings available on Spotify, Apple Music, Amazon Music, Pandora, and YouTube.

In my free time, I enjoy boating, reading, learning new things, learning Italian, and spending quality time with my wife, family, and friends.

Partner

I am proud to serve as a Partner, Portfolio Manager, Member of the Operating Committee, and Member of the Investment Committee at ARS Investment Partners. With over 29 years of experience in the financial services industry, my primary responsibilities include managing assets for high-net-worth and institutional clients, collaborating on the firm’s investment implementation, and nurturing client relations.

Before joining ARS Investment Partners, I had the opportunity to work at A.R. Schmeidler & Company and GasPedal Ventures, which provided me with a diverse and enriching professional background. I earned my Bachelor of Arts in Government from Skidmore College in 1991, and my journey in finance began shortly thereafter. My background as an equity analyst covering multiple sectors has given me a broad perspective that I bring to portfolio management. I am deeply motivated by gaining a thorough understanding of the critical trends and themes that develop over time, particularly those that can solve societal challenges and create value for our clients.

What I love most about my work is helping people and working collaboratively. The interdisciplinary nature of this business is incredibly inspiring to me; the broader and deeper one’s knowledge base, the greater the value one can bring. Ours is a field where you can leverage both analytical and strategic thinking, and I’ve always been fascinated by understanding how the world works, finding interconnections, and determining how to make these beneficial to investment positioning. I believe that the greatest value I can offer our clients is determining asset allocation and investment positioning aimed at meeting their needs and long-term goals, while providing a steady hand through challenging times.

A native of Larchmont, New York, I currently reside in Manhattan with my wife, our two children, and our Goldendoodle, Bodie. In my free time, I enjoy playing sports and boating with family and friends, traveling to wine-inspired locations, and taking long walks and hikes with Bodie and anyone else who will join us. For downtime, I play guitar, discover new music, read, and listen to an eclectic range of educational podcasts and long-form interviews on YouTube.

Director of Client Services

As the Director of Client Services at ARS Investment Partners, I am responsible for the day-to-day operations of our firm’s client service department. My goal is to deliver superior service to our clients by driving and optimizing the effectiveness and efficiency of people, processes, and technology within the department and the firm. I am dedicated to maintaining and supporting the delivery of the highest standards of service and execution for all our clients. To me, our clients are like family, and I am committed to assisting them with any and all needs.

I have been working in the financial services industry since 2005. Before joining ARS Investment Partners, I was the Director of Client Services and Administration at Somerset Capital Advisers, LLC, a role I stepped into when I joined the company in 2005. Prior to that, I honed my operational skills in various capacities at the Yale University Bookstore. I received my BA in Government and Philosophy from Hamilton College.

On the client side, I love solving problems for clients or helping them view what they see as a problem or question in a different way. Internally, I enjoy finding new ways to make our jobs both more efficient and easier to manage. I firmly believe that the greatest values I can provide for our clients are my availability and willingness to go the extra distance to meet their needs.

A native of North Haven, Connecticut, I currently reside in the vibrant neighborhood of Greenpoint, Brooklyn.